|

|

|

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

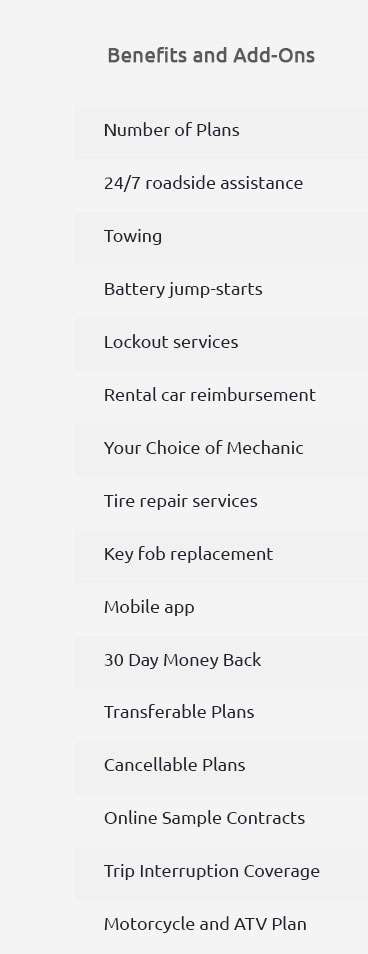

Breakdown Repair Insurance: A Comprehensive Coverage GuideExploring breakdown repair insurance can be a smart move for U.S. consumers looking to protect their vehicles and save on unexpected repair costs. This type of insurance offers peace of mind by covering many of the expenses associated with vehicle breakdowns, ensuring that drivers are not left with hefty bills. Understanding Breakdown Repair InsuranceBreakdown repair insurance is designed to cover the costs of repairing or replacing parts of your vehicle if it breaks down unexpectedly. This can be a lifesaver for those who rely on their cars for daily commuting or long trips. Key Benefits

What Does It Cover?Typically, breakdown repair insurance will cover:

For a deeper dive into how these coverages affect your overall costs, consider reviewing complete car warranty cost resources. Comparing with Extended Auto WarrantiesMany consumers also look into extended auto warranties, which can offer similar benefits. It's essential to compare the two options to determine which suits your needs best. Why Choose Breakdown Repair Insurance?While both options provide valuable protection, breakdown repair insurance often focuses more on covering unexpected mechanical failures. This can be ideal for vehicles that are no longer under the manufacturer's warranty. For specific vehicle needs, such as Buick extended warranty options, exploring tailored plans might be beneficial. Frequently Asked QuestionsWhat is the difference between breakdown repair insurance and an extended warranty?Breakdown repair insurance typically covers specific mechanical and electrical failures, while an extended warranty can offer broader coverage including additional perks like roadside assistance. How much does breakdown repair insurance cost?The cost varies based on factors such as the make and model of your vehicle, coverage level, and location. It's advisable to compare quotes from different providers to find the best deal. Is breakdown repair insurance available for older vehicles?Yes, many providers offer coverage for older vehicles, although the specifics can vary. It's important to check the terms and conditions for any age or mileage restrictions. In conclusion, breakdown repair insurance offers a viable solution for drivers seeking protection against unexpected repair costs. Whether you're cruising through California or navigating the busy streets of New York, having this coverage can make all the difference. https://www.nationwide.com/business/insurance/equipment-breakdown/

What does equipment breakdown insurance cover? - The cost to repair or replace the damaged equipment - Costs for time and labor to repair or replace the equipment ... https://wallethub.com/answers/ci/what-is-covered-under-the-general-mechanical-breakdown-coverage-1000298-2140759638/

WalletHub, Financial Company ... The General does not offer mechanical breakdown insurance. Mechanical breakdown insurance (MBI) is a specialty ... https://www.nationwide.com/lc/resources/small-business/articles/what-is-equipment-breakdown-insurance

What equipment breakdown insurance covers - The cost to repair or replace damaged equipment, including time and labor - Lost income - Spoiled inventory - Necessary ...

|